Finance

Budgets

The Borough continues to face falling revenues and rising costs across personnel, insurance, equipment, and supplies. As a result, the Borough is experiencing a financial crunch that makes it increasingly difficult to deliver essential services, including Police, EMS, Public Works, and community infrastructure.

On the revenue side, the Borough has experienced several losses, including:

- A reduction of approximately $5,000 in anticipated Real Estate Transfer Tax revenue.

- A reduction of approximately $10,000 in Cable TV Franchise Fee revenue. The Borough receives 5% of the gross revenue of cable companies operating here; however, as more residents discontinue cable service, this revenue source continues to shrink.

Due to these financial pressures, the Borough has made the difficult decision to increase property taxes by 1 mill.

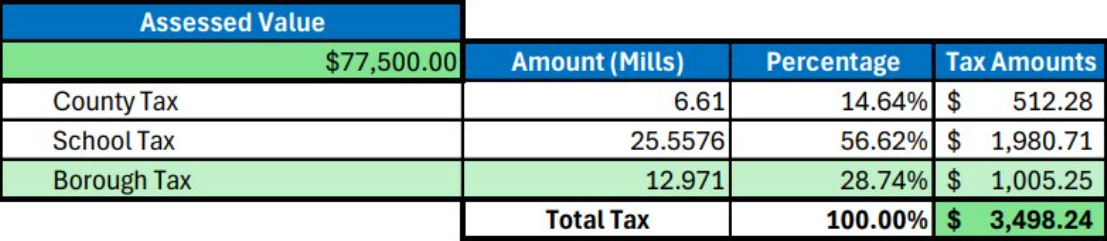

- For the average property in the Borough, valued at approximately $77,500, this increase amounts to about $79 per year, or roughly $6.50 per month.

This 1-mill increase generates an estimated $80,000 in additional revenue. These funds will help cover several unavoidable increases in operating costs, including:

- $55,000 increase in Public Safety expenses due to the new Police Department contract for 2026–2030. This increase was necessary because the department had been the lowest-paid in the local market, creating significant challenges in recruiting and retaining officers.

- $20,000 increase in insurance costs, including liability coverage and employee health plans.

- $15,000 increase in wages for Public Works and Borough Office staff.

- $10,000 increase in electricity costs for Borough streetlights.

Despite these challenges, the 2026 budget invests significantly in community infrastructure and services, including:

- $247,500 for road reconstruction and maintenance, plus $530,000 secured through a grant obtained by the Borough Office.

- $25,800 for storm drain improvements.

- $16,200 for traffic signals and signage.

- $22,130 for code enforcement, supporting efforts to address blighted properties throughout the community.

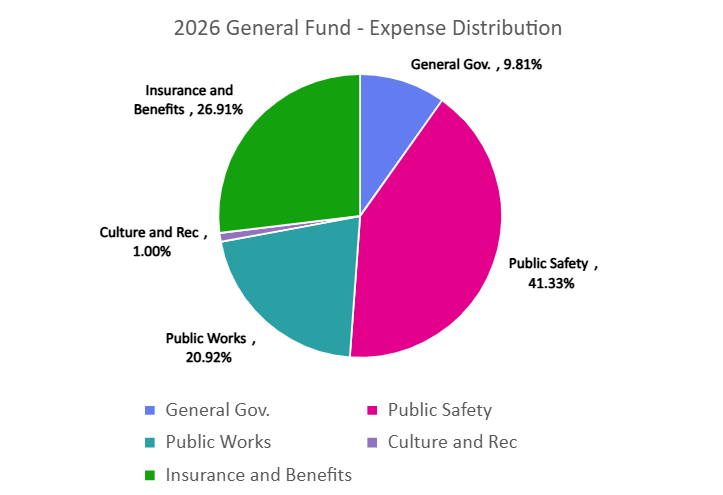

Below is the distribution of expenses by category for the Borough – General Fund.

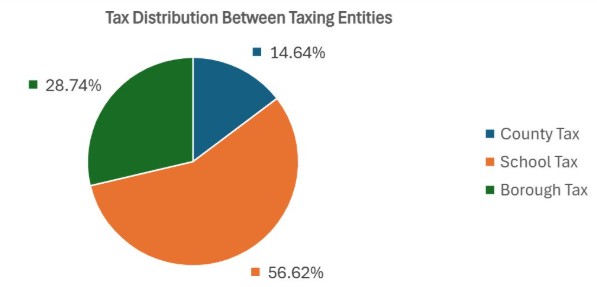

Below is a snapshot of the tax picture for the average property in Wesleyville. It outlines the totals between the taxing authorities (Borough, School, and County). Note, only 30% of the property tax paid ultimately makes its way to the Borough.

Fee Schedule

2026 Fee Schedule

2025 Fee Schedule

Audits

2026 Annual Audit

2025 Annual Audit